Key Takeaways:

- ESCO is a type of insurance that can add coverage for loss, damage, or repair after a hearing aid's warranty has expired.

- ESCO is the most widely used post-warranty hearing aid insurance, but Midwest is another 12-month option for residents of AR, FL, VA, or WA.

- Plans vary in coverage and cost is quoted according to the selected plan and hearing aid.

- If you need to file an ESCO claim, you can reach out to your audiologist and they'll submit the claim to ESCO for you.

As an experienced audiologist, I have had the wonderful opportunity to assist numerous patients in optimizing their use of hearing aid technology over the years. Over the years, I've learned that maintaining optimal hearing health extends beyond the initial fitting— it's about ensuring the durability and longevity of the technology that enables you to connect with the world around you.

Financial considerations are undeniably a significant part of making the most out of your hearing technology. One solution I often recommend to my patients is ESCO hearing aid insurance. This insurance not only provides coverage against loss and damage, but it also acts as a safety net long after the manufacturer's warranty has expired, offering a continued protection and peace of mind for your valued investment.

Most hearing aids come with a warranty that lasts three years. Once the warranty expires, wearers can upgrade, pay for hearing aid repairs out of pocket, or purchase a new insurance policy through a 3rd party company like ESCO.

This guide will cover everything you need to know before purchasing ESCO insurance, including prices, reviews, and how to make a claim.

What is ESCO hearing aid insurance?

Hearing aids spend a lot of time in the warm, damp environment of the ear and require regular care and maintenance to preserve proper function.

Hearing aid warranties typically cover three years of repair costs for faulty pieces and parts. However, hearing aids can still function well for years beyond the typical warranty expiration.

ESCO is an independent insurance company that provides hearing aid insurance to cover the years after typically warranties are complete.

Who is behind ESCO?

Esco began in 1989 to protect against hearing aid loss and damage. The company is the largest provider of extended hearing aid warranties in the country. ESCO offers various coverage plans, ranging from basic loss and damage coverage to plans that cover all repairs.

Are there other hearing aid insurance providers?

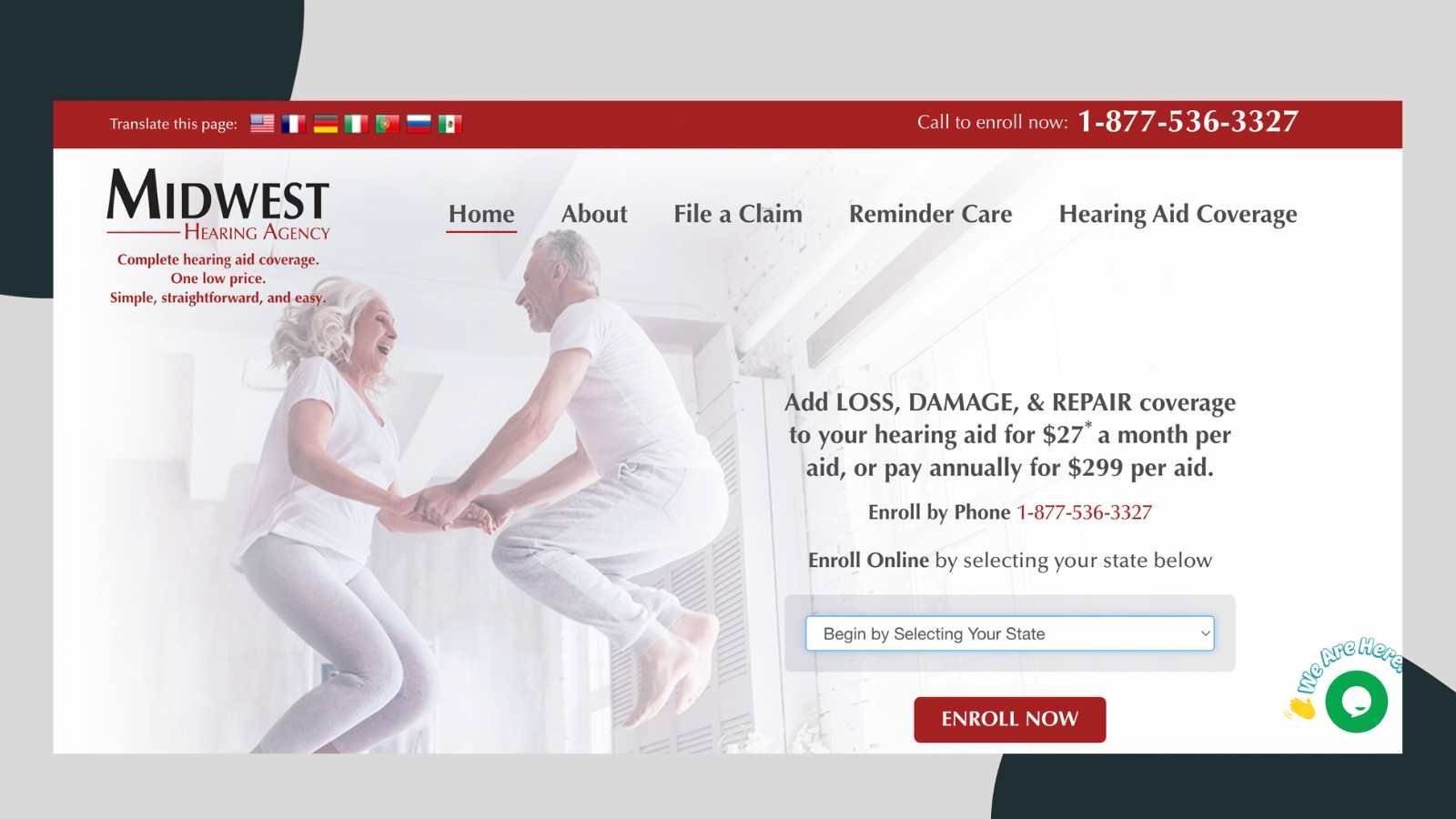

Midwest Hearing Agency is another trusted company that has offered hearing aid insurance policies for over 50 years.

Midwest Hearing Agency provides a single-price policy for 12 months that can be more affordable than ESCO. Midwest Hearing Agency is unavailable in AR, FL, VA, or WA.

When Do You Purchase ESCO?

You can purchase ESCO once your hearing aid warranty has expired. The policy you buy from ESCO takes over from the point of purchase.

ESCO coverage varies depending on the type of device that you have and whether you pay annually or in monthly installments.

The least expensive ESCO plans start at around $40 per month for a pair of hearing aids, and the most expensive plans cost approximately $70 per month for pair of hearing aids.

Midwest Hearing Agency advertises similar pricing at around $54 per month for a pair of hearing aids.

What coverage is available through ESCO?

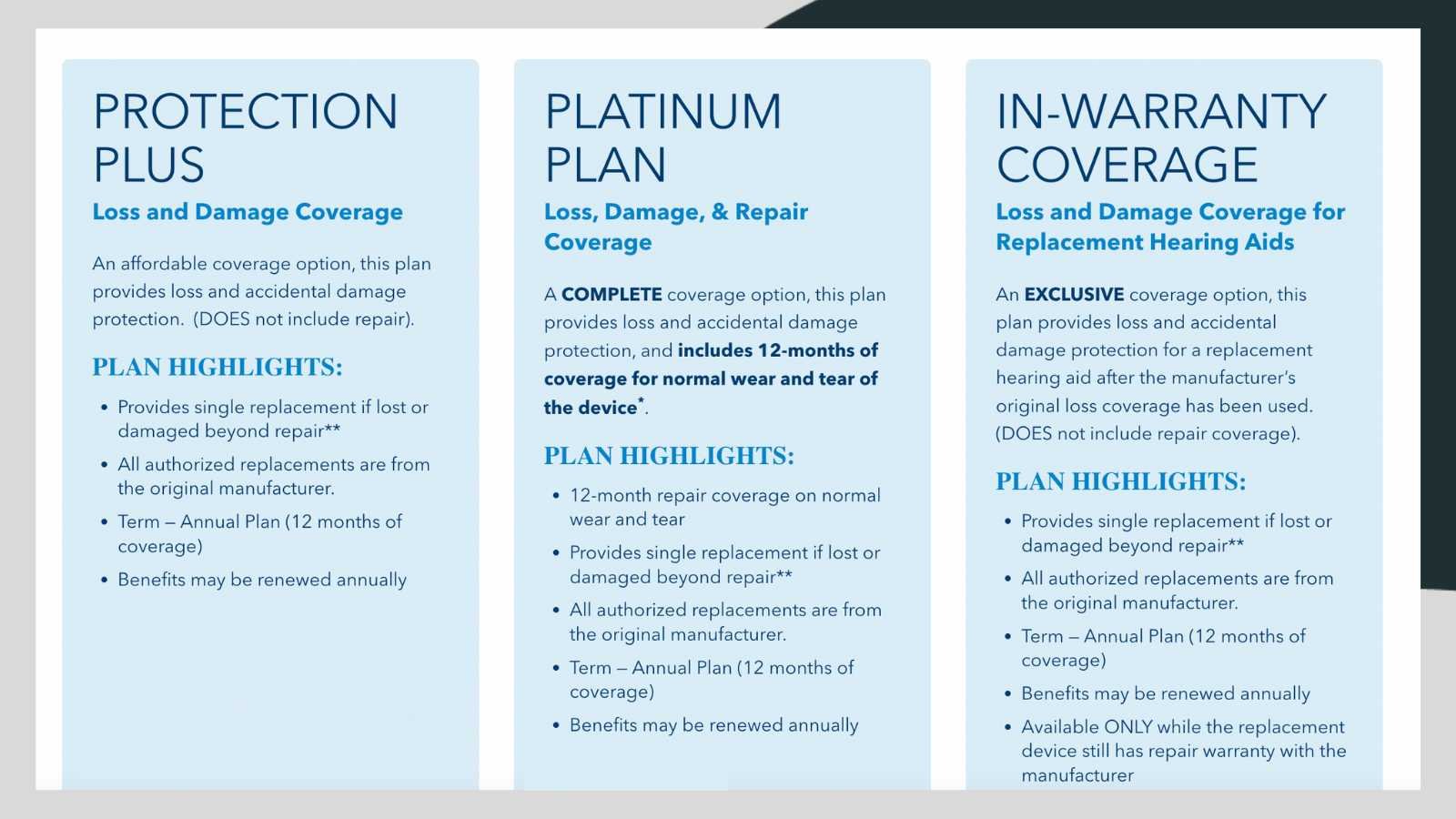

ESCO offers three plans: protection plus, platinum, and in-warranty coverage. These plans are renewed annually.

Protection Plus - Least Expensive

A Protection Plus plan covers loss or accidental damage to your hearing aids. However, this plan does not include repair coverage for normal wear and tear like microphone issues or battery drain. This option is a good plan for those looking to have some insurance in case they lose or damage their hearing aids while still keeping expenses to a minimum.

Platinum Plan - Most Expensive

The Platinum plan covers normal wear and tear and replacement for loss or damage. The price for this plan will be higher than the Protection Plus, but it covers additional repairs that the simpler plan does not. So if you need more frequent hearing aid repairs, this plan will offer better ROI.

In-Warranty Coverage - Mid-Tier

Are you within your manufacturer's original warranty but have already used your hearing aid warranty's loss and damage policy? Consider In-Warranty Coverage. This Esco policy will provide additional coverage if you lose or damage your hearing aids beyond repair a second time. This type of policy leaves basic maintenance to your original warranty.

How to file a claim with ESCO

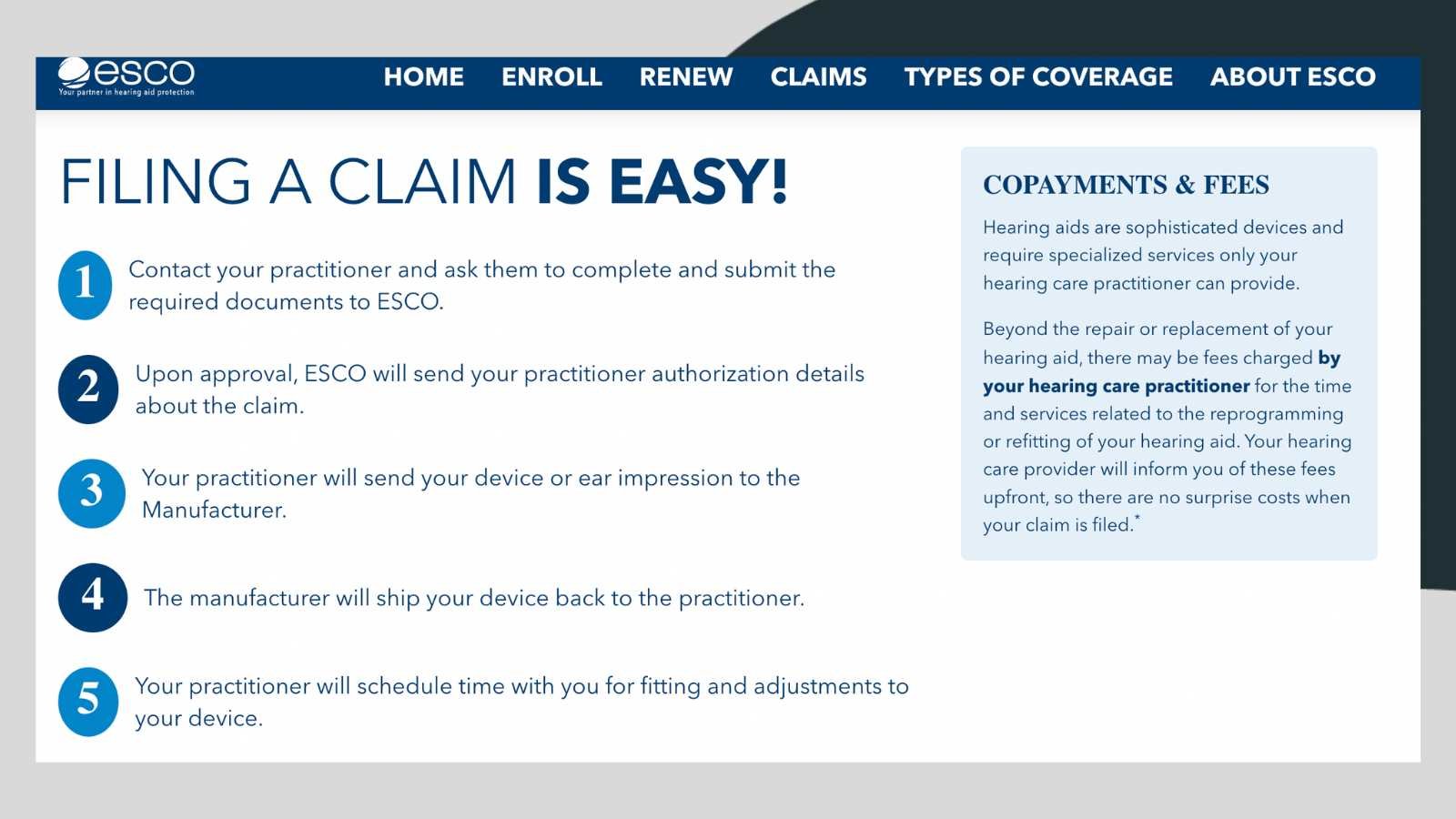

For a hearing aid user, filing a claim with ESCO is relatively easy. ESCO requires that an audiologist file the paperwork, which means you'll need to contact the clinic where you purchased your hearing aid and let the audiologist know that you need to file a claim.

The audiologist will file the paperwork and work with ESCO to file your claim. Once ESCO receives your claim, they will notify the audiology clinic to process the repair or other requests.

Then, if approved, they will begin processing your claim immediately so you can get the hearing aid repaired or replaced quickly.

Who Is ESCO Right For?

ESCO offers excellent coverage for anyone looking for reliable protection and peace of mind.

If you're looking to get the most possible out of your hearing aids, ESCO is a good option.

Without ESCO, you are entirely liable for any hearing aid repairs due to damage or replacement of a lost hearing aid.

On average, hearing aid repairs cost $250 - $600 per ear, depending on the issue.

ESCO can be a good option if you're looking to maximize the life of your hearing aid beyond its warranty.

However, some people find that with good care routines with their devices, they feel comfortable simply wearing them without this policy. You know yourself best!

Conclusion

ESCO is a trusted name in hearing health and offers several plan options. Whether you are looking for extended warranty coverage or supplement loss and damage coverage, their plans are worth considering.

The in-warranty coverage, protection plus, and platinum plans provide different coverage levels so that you can get a policy that works for your budget.

In my experience, the claims process is fairly easy to follow, and ESCO's customer service team is always available to help you with any questions or problems about your policy.