Key Takeaways:

- Hearing healthcare can be a large out-of-pocket expense, so it's helpful to explore ways to save money when it comes to hearing aids.

- Some individuals qualify for tax deduction based on the percentage of their income they spend, whether they use an HSA, or qualify for EITC or disability tax credit.

- Read specific examples below to see if you qualify.

If you have hearing loss, you know hearing aids can be prohibitively expensive. Fortunately, there are some tax deductions available that can help offset the cost of hearing aids.

Like most things from Uncle Sam, there are a few restrictions. Here's what you need to know about claiming hearing aids on your taxes.

Do hearing aids qualify for tax deduction?

Hearing loss is a medical condition that affects over 30 million Americans, and in many cases, hearing aids are an appropriate intervention for improved hearing.

Thus, hearing aids fall into the medical expenses category in the eyes of the tax authorities. Other items that also fit this category include general medical expenses, dental care, eye care etc.

So the short answer is, yes, hearing aids qualify for a tax deduction. However, the answer in your specific situation will depend on a few factors:

- Did your out-of-pocket medical care expense exceed 7.5% of your adjusted gross income?

- Did you pay for your hearing aids through a health savings account (HSA)?

- Do you qualify for the Earned Income Tax Credit (EITC) or the disability tax credit?

Itemizing Medical Expenses (Including Hearing Aids)

When claiming a tax deduction for your medical expenses, you can only deduct the amount that is more than 7.5% of your adjusted gross income.

For example, if your adjusted gross income is $60,000, you can only deduct any allowable medical expenses above $4,500.

For those with significant out-of-pocket medical and dental expenses, itemizing may be a great way to take advantage of potential tax benefits. Here are some of the items the IRS permits to be deducted from taxable income:

- Hearing aids, hearing aid supplies, and hearing care costs

- Fees for other doctors

- Fees for dentists

- Fees for surgeons

- Fees for chiropractors

- Fees for psychiatrists

- Inpatient or nursing home care

- Acupuncture treatments

- Smoking-cessation

- Weight-loss programs for specific diseases diagnosed by a physician

- Insulin and other prescription drugs

In some cases, hearing aids can cost up to $7,000 and are often not covered by insurance - itemizing these expenses may offer some financial savings at the end of the year. Explore more affordable hearing aid options here.

Any costs from transportation traveling to medical appointments can also qualify towards the tax-deductible total. You'll want to keep receipts and records from any gas, tax fare, tolls, or other expenses related to transportation to and from the medical clinics.

To see if your medical expenses, such as hearing aids, qualify for a tax deduction, total all out-of-pocket medical expenses and calculate whether these exceed 7.5% of your gross income. The balance above 7.5% is your write-off number.

The amount of money you can deduct from your taxes depends on several factors, including your filing status and income level. You can calculate the amount you can deduct under Schedule A on form 1040 or 1040-SR.

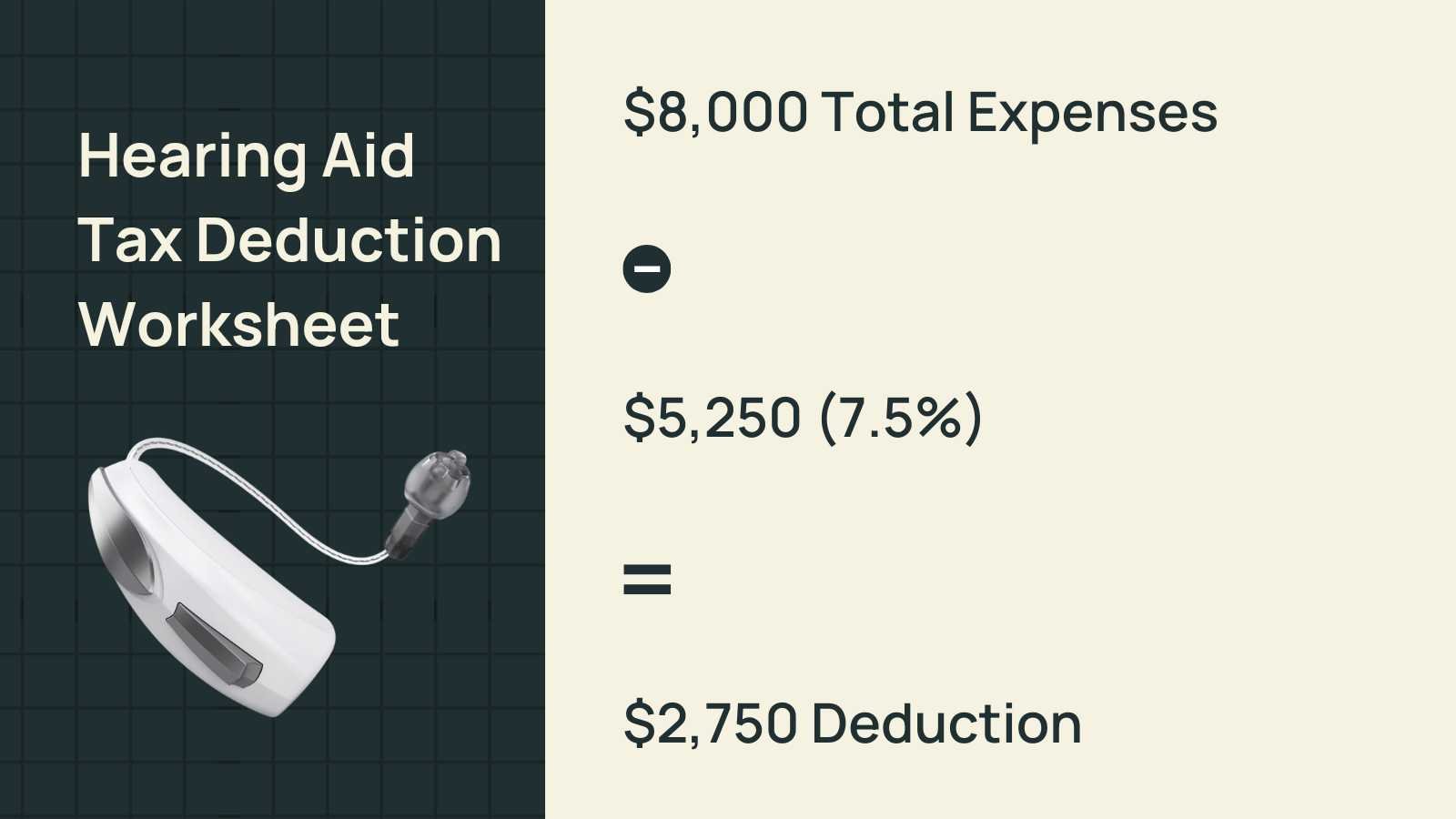

Doing the Math (An Example)

Now let's look at a specific example:

Sally makes $70,000 annually and wants to know whether she qualifies for tax deductions from the hearing aids she purchased this year.

First, we'll need to calculate whether her out-of-pocket medical expenses exceed 7.5% of her gross income.

Time to get out the calculator!

$70,000 (Sally’s gross salary) x 0.075 (7.5% of gross salary) = $5250

Remember that this is an aggregate deduction; it applies to all qualifying medical expenses incurred during the year, not just those related to hearing aids.

For example, Sally purchased a pair of premium hearing aids out-of-pocket from a local hearing aid clinic for $6,000 and had other out-of-pocket medical expenses totaling $2,000 this year. Now let's calculate the difference from the 7.5% of her adjusted gross income:

Total out-of-pocket medical expenses this year: $8,000

7.5% of Sally's adjusted gross income: $5,250

Total tax amount qualifying for tax deduction: $2,750

Hearing Aids and HSAs

If Sally had paid for her hearing aids through an HSA, this tax deduction calculation would not apply. When Sally paid through her HSA, she already took a tax deduction on money placed in an HSA.

However, HSAs are a great way to save on out-of-pocket costs regarding your hearing health needs. Many employers offer them as an option, so it's worth checking with yours to see if you qualify.

These accounts make it possible to use pre-tax dollars towards medical expenses such as co-payments, deductibles, and other health care costs that can quickly add up. For eligible people, contribution limits range from $3,550 for individuals to $7,100 for families and can vary depending on the type of coverage, eligibility date, and end date.

HSAs are a simple yet effective way to manage hearing healthcare costs without breaking the bank.

Do you qualify for the Earned Income Tax Credit (EITC) or disability tax?

Before we wrap, there are two other tax credits that might help offset the cost of hearing aids. Both are pretty vague and nuanced, so we recommend you talk to your tax accountant about whether you might qualify.

Disability Tax Credit With Hearing Loss

The disability tax credit is intended for those at least 65 years old who had to retire due to their disability and currently receive taxable disability income. To take advantage of this credit, you will need a statement from a qualified physician to confirm that your disability, whether hearing loss or other disability, is severe enough that you cannot work.

Read more about disability tax credits and hearing loss.

Earned Income Tax Credit (EITC)

The IRS has specific requirements to qualify for EITC. If you've earned less than $57,414 in the last year and spent a significant sum on hearing aids, you should talk with your tax accountant about the EITC.

Final Thoughts

Determining whether or not your hearing aid costs are tax deductible is not always straightforward, but it's worth doing the math if it will save you money in the long run.

Be sure to consult with an accountant or tax professional who specializes in this area so that they can help guide you through the process of filing for these deductions correctly. By understanding how and when hearing aids qualify for tax deductions, you may save some money on your taxes this year.