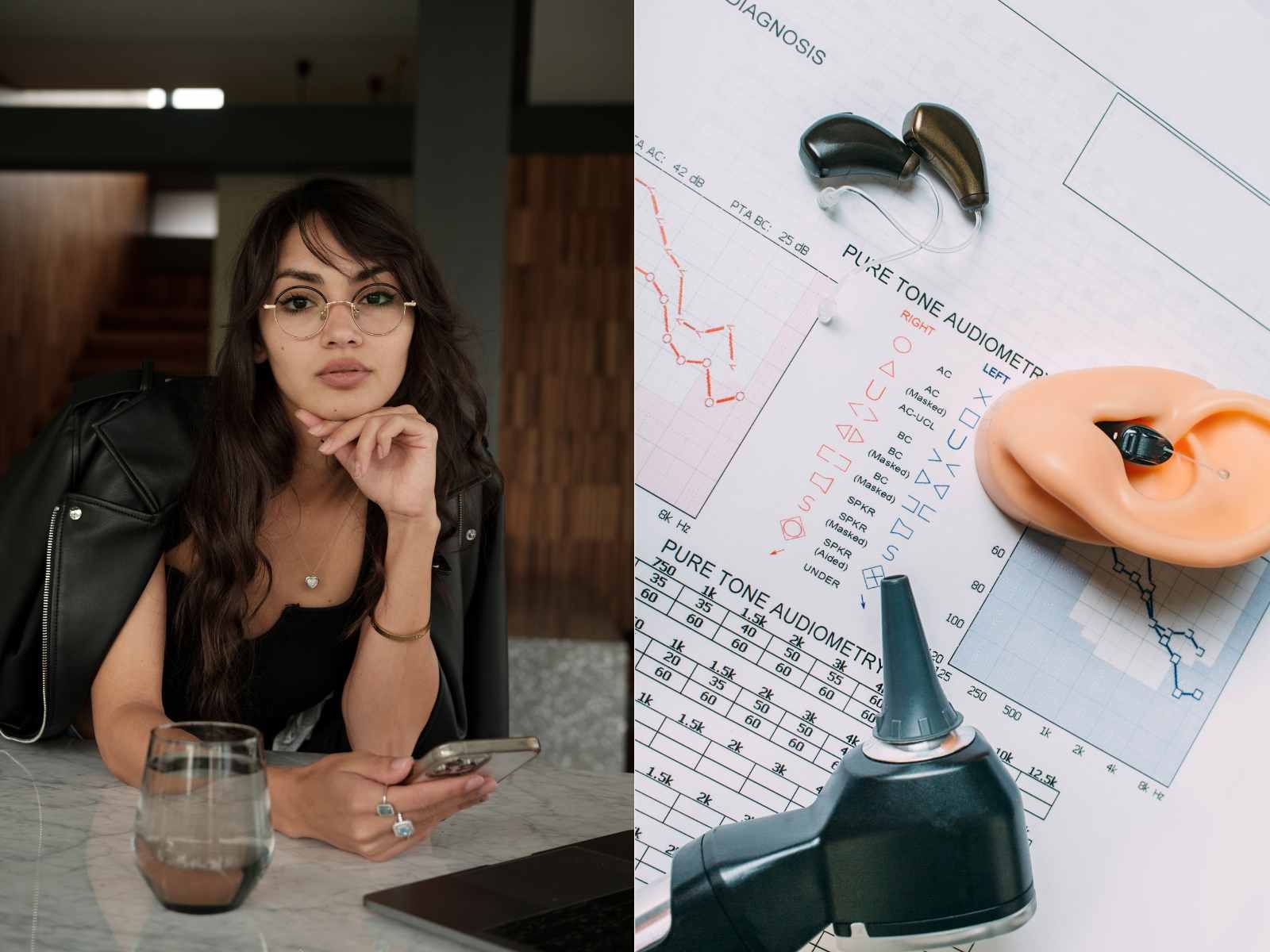

As an audiologist, I work with patients with hearing loss on a daily basis. Hearing loss is among the most common health problems worldwide, affecting millions.

It's no secret that healthcare can be expensive, including hearing aids and hearing tests. But, did you know that your health insurance might cover them?

Most of the time, if your doctor's office is in the network and takes your insurance, they'll process the insurance claim for you. However, depending on your circumstances and insurance type, you may need to self-submit a claim to receive a reimbursement.

The only catch is, depending on your insurance, you may need to jump through a few hoops to receive a reimbursement.

Curious to learn more about submitting to insurance? Keep on reading and get the intel.

Where to start?

Insurance coverage differs from plan to plan. To verify your plan's benefits, you will have to be a bit of a detective.

First, check out the back of your health insurance card, where you'll find the number to call.

Ask the representative about your plan benefits. Specifically, you'll want to ask if you have hearing loss and hearing healthcare coverage, including hearing tests and hearing aids.

If there is anything you need help understanding, be sure to ask and clarify your questions. For example:

- Does your policy include coverage for hearing aids at any audiologist's office?

- Or, do you need to go with a specific brand?

- Do you require prior authorization for a test or procedure?

What Happens After The Doctor's Office Visit

You did your bit by visiting the doctor, but that's hardly the end of it.

Most commonly, if your doctor’s office accepts your insurance and is in-network, they'll send a bill to your insurance company for what wasn't paid at the visit. The insurance folks will review and process your claim, and you'll get a bill for the remainder.

Services covered by your plan will be paid in part or in full, and then you will receive a bill for the remainder, if any. After everything has been processed, you'll receive an Explanation of Benefits (EOB) from your health insurance that explains your health insurance and details just how much your plan is shelling out for the covered services.

However, if your doctor is out-of-network for your health insurance plan, you may need to submit your own claim. In the next section, we’ll go through how to file a claim.

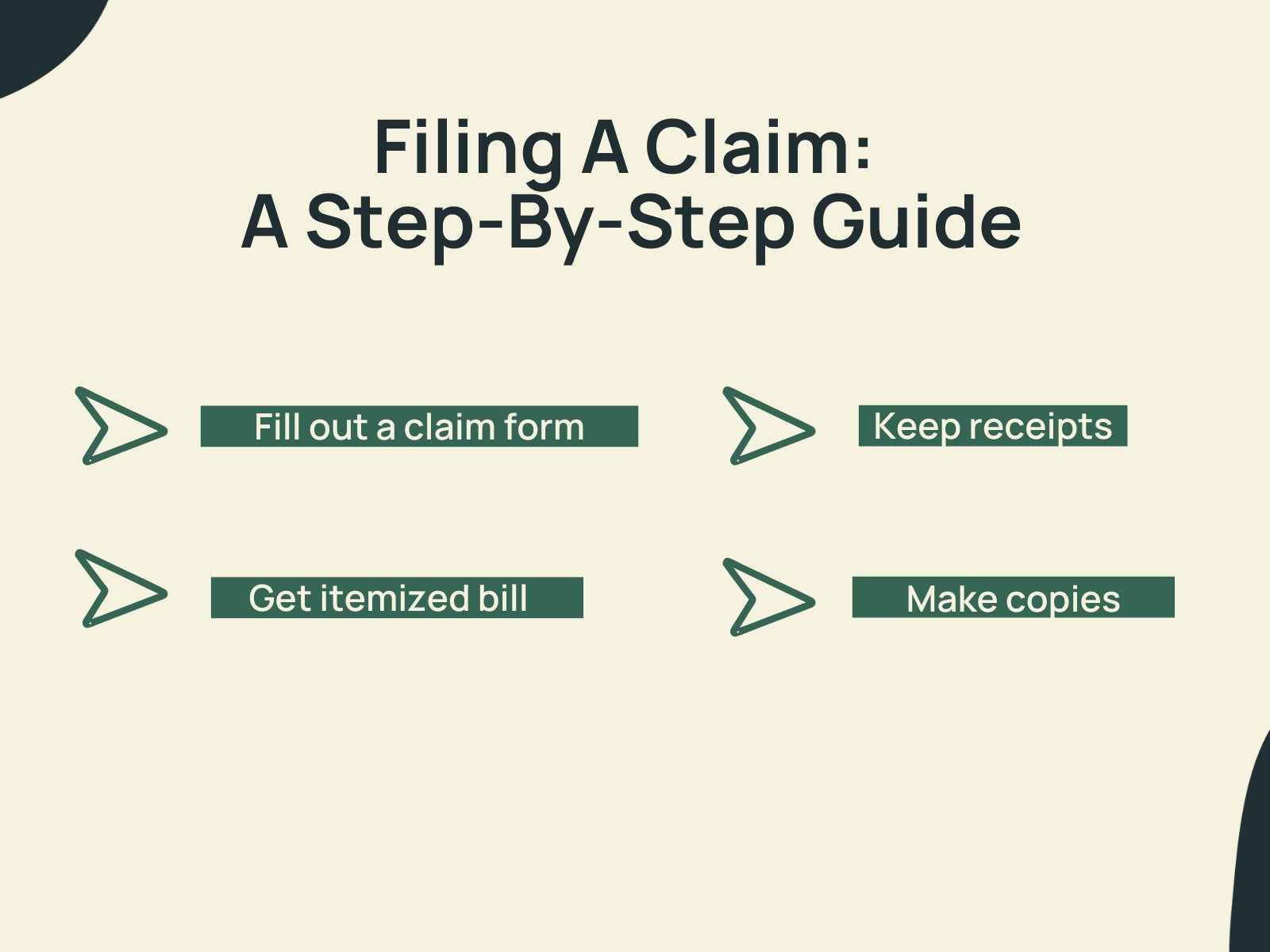

Filing A Claim: A Step-By-Step Guide

One important disclaimer here is that every health insurance is different and will have different forms, requirements, and policies. While these steps will help guide you, always check with your insurance regarding their policies and procedures.

1. Get an itemized bill and receipts.

Ask your doctor or hearing care provider to provide you with an itemized bill and receipts. They can provide you with a superbill to submit to your insurance.

2. Fill out a claim form.

Get the claims ball rolling!

You can snag a form online or—if you're feeling nostalgic—fill one out by hand. Just remember to print neatly.

Outline everything your plan requires and furnish all necessary details, including policy numbers, diagnostic codes, and contact info, then submit.

However, if you write by hand, you'll want to write clearly, neatly, and legibly. The claim form will vary, depending on insurance. However, you'll need to provide It's crucial to fill out this form accurately, providing as much necessary information as possible, including your policy number, diagnostic codes, and contact details. It is essential to submit claims in a timely fashion to insurance.

3. Make copies

Make a copy of the bill and receipts, the completed claim form, and any other supporting documents. Make copies of everything for your records and also—if need be—you need to resubmit the claim due to an error.

Duplicate your itemized bill and receipts, the completed claim form, and other supporting documents. Note: You can also digitize them for your records, too.

What can I do if my claim is denied?

Unfortunately, insurance claims can sometimes be denied even when you've done everything right.

Knowing your insurance policy and understanding claim rejections is vital. If you're unsure, contact the provider and clarify your options.

Understanding your insurance policy and why your claim has been rejected is crucial. If you're unsure or disapprove of the decision, ask your insurance provider about your options for the next steps.

Sometimes, a few clarifications from your hearing provider may be enough to approve the claim. With some effort from your end, your hearing provider can help get your claim approved.

Common Reasons Claims are Denied

Insurance troubles? Denied claims? Don't fret!

Knowing your insurance policy and understanding claim rejections is critical. If you're unsure, just contact the provider and clarify your options.

But with some effort and persistence, your hearing provider can help get your claim approved.

It can be frustrating when your claim is denied. ASHA offers this helpful resource for those dealing with claim denial.

Consider these common reasons for the denial to help you prepare and prevent a denial.

Common Reasons Claims Are Denied:

- Information is incomplete, missing, or incorrect.

- Treatment or service is not deemed medically necessary.

- Treatment or service is not a covered benefit in your plan.

- Prior authorization was not sought (when required by insurance).

Can I self-submit a claim for an OTC hearing aid?

Every health insurance plan is different.

While most plans do not cover OTC devices, two brands are more likely to work with your health insurance: Eargo and MDHearing.

If you have supplemental hearing benefits through NationsBenefits, Eargo hearing aids will likely work with your hearing benefit. Similarly, MDHearing has partnered with MedLine and is working on expanding hearing healthcare, including OTC hearing devices like MDHearing, as of 2024.

Final Thoughts

Self-submitting a claim for your hearing aids or hearing test may seem daunting, but it's essential for reducing costs and getting the reimbursement you deserve.

Points to remember:

- Submission requirements can vary by the insurance provider.

- Making sure the claim is legible, accurate, and including supporting documents is critical.

If you find the process overwhelming, feel free to seek help from your hearing care provider or insurance provider. With a bit of patience, you'll be on your way to getting the coverage that you need for hearing healthcare.